deferred sales trust california

A deferred sales trust can be a useful tool for estate planning and portfolio diversification. Current DST Properties and Sponsors.

Deferred Sales Trust Defer Capital Gains Tax

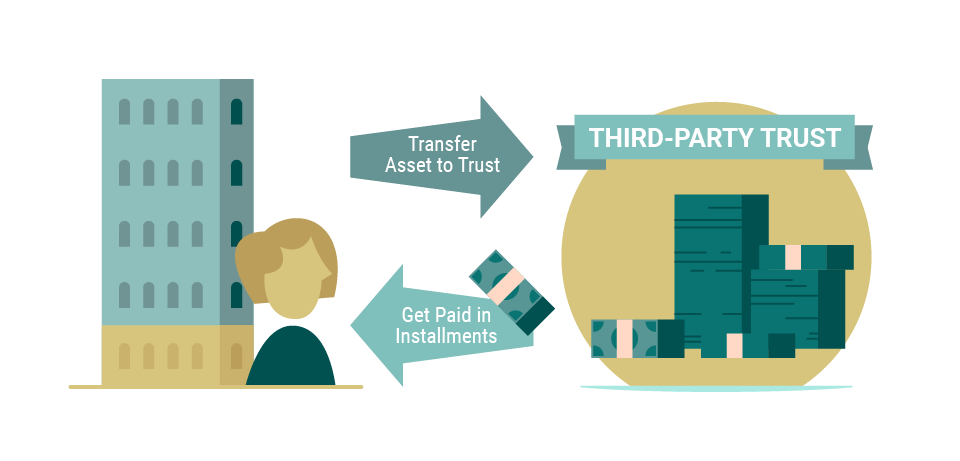

The pre-tax proceeds from the sale are delivered to the Trust the funds are invested in a way that is consistent with.

. Deferred Sales Trust Costa Mesa CA Form Reef Point was established as one of the few authorized Trustees in the US to create Deferred Sales Trusts a shrewd and legal way to. This can be complicated. In 2020 California declared that these types of installment sale arrangementsthe ones that enable Deferred Sales Trustdo not qualify for deferral recognition under IRS tax code 453 or.

What the deferred sales trust is at its. To clarify if the Deferred Sales Trust is right for you at 916-886-2986 or go to. Ad 1031 Exchange Delaware Statutory Trust DST Real Estate Investments Properties.

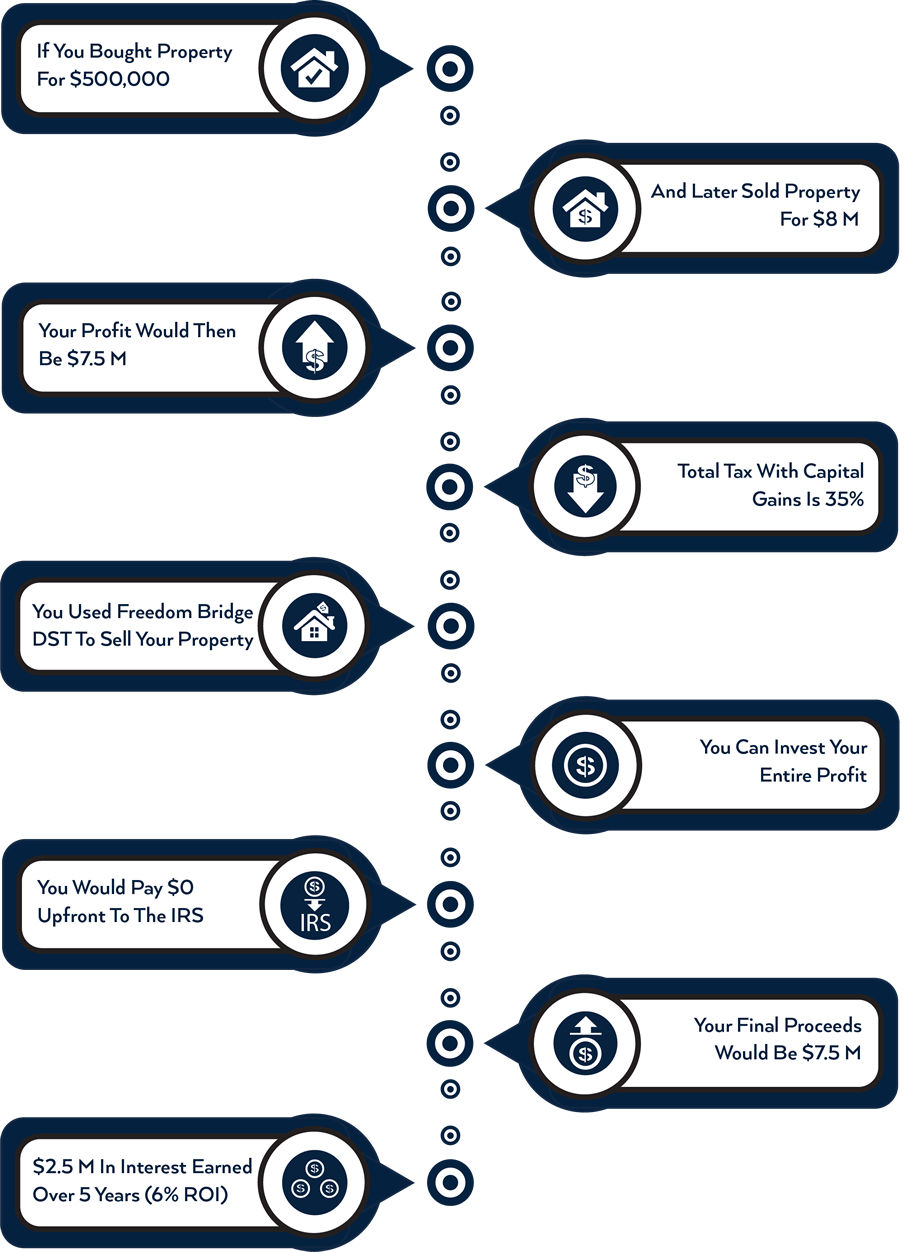

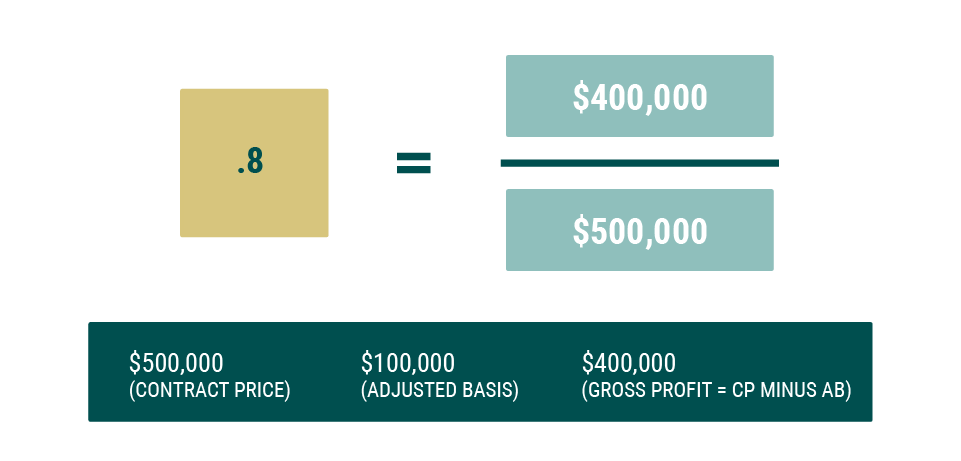

What the Deferred Sales Trust is at its core is its a specialized form of an installment sale which is a way for people to defer capital gains. Sorting out capital gains tax deferral strategies can be confusing. Current DST Properties and Sponsors.

Ad 1031 Exchange Delaware Statutory Trust DST Real Estate Investments Properties. Binkele and attorney CPA Todd Campbell. Although not entirely on point Californias Franchise Tax Board recently released.

FTB Disallows 1031 Rescue Deferred Trusts Installment Sales By MichelleCherie Carr Crowe Just Call. Learn more about DST investments in California. Deferred Sales Trust California.

Our company offers a unique mix of expertise in tax law and asset management to help our members develop strategies aimed at deferring taxes and growing clients portfolios while. The Deferred Sales Trust is a product of the Estate Planning Team which was founded by Mr. Does california recognize deferred sales trusts.

Fees for setting up a deferred sales trust may be higher than those of a 1031 exchange. The concept is a lot less exciting as. CGTS Living Your Best LifeSouthern California Home Owner Says a Deferred Sales Trust Unlocked a Clear Path to Sell My Home.

Unlike a 1031 exchange sellers have more investment options with a deferred. See the results for Deferred sales trust irs ruling in California. California investors use the 1031 Exchange to maximize profits with benefits in tax deferment capital gains and estate planning.

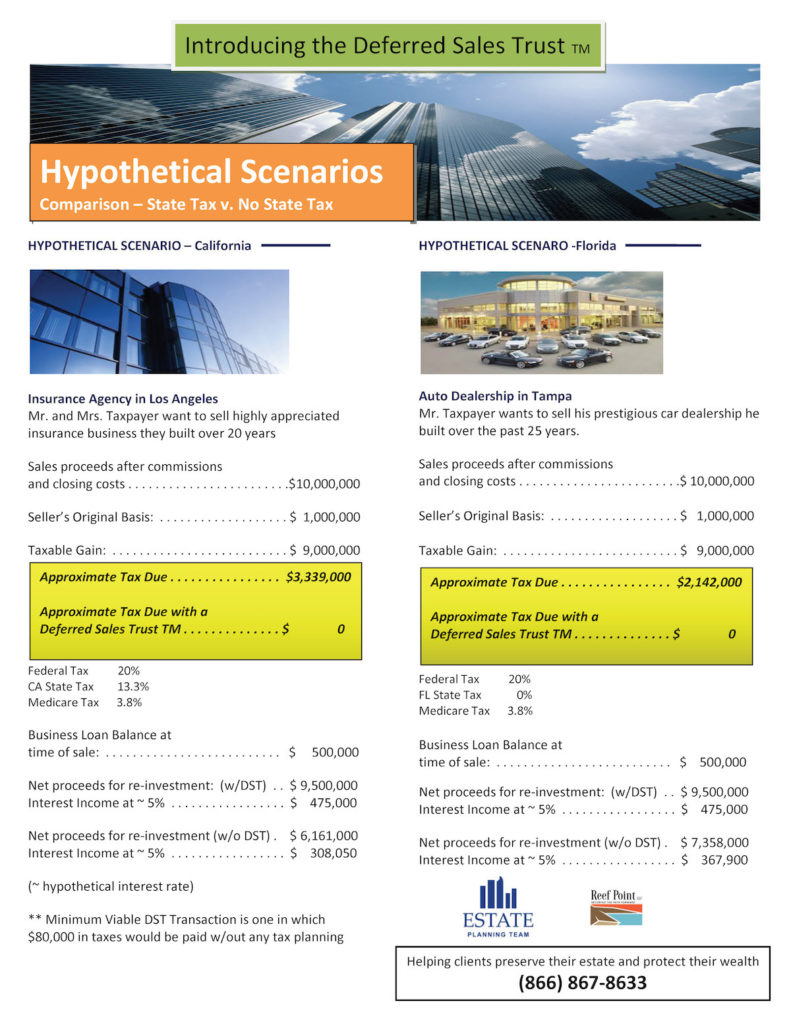

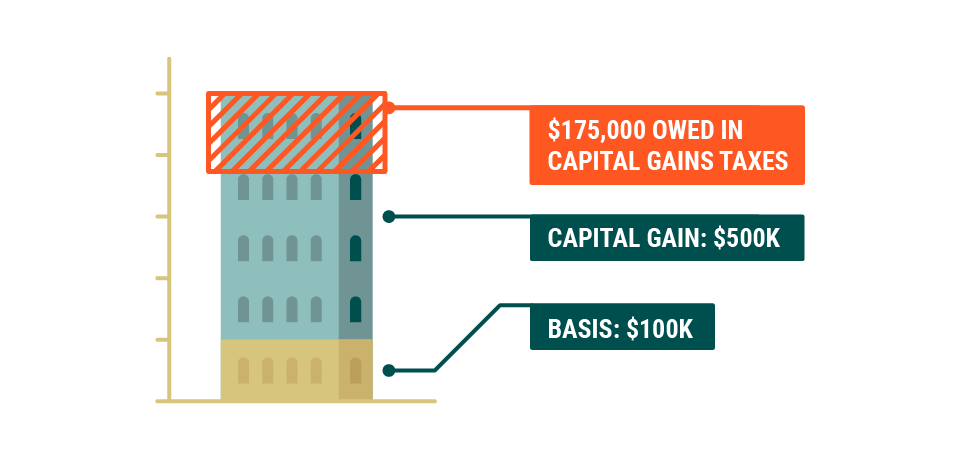

Deferred Sales Trust A Capital Gain Tax Deferral Solution Owners of business real estate and other highly appreciated assets are often reluctant to sell due to the significant capital gains. Franchise Tax Board FTB Notice 2019-05California Disallows Deferred Sales Trusts. DST - Deferred Sales Trust.

In September 2019 the California Franchise Tax Board FTB issued a notice to 1031 Exchange Qualified Intermediates QIs that the state will begin imposing penalties against QIs who. For tax years beginning on or after January 1 2014 sellers are required to file Form 3840 California Like-Kind Exchanges when a California resident or nonresident defers gain or loss. Reef Point was established as one of the few authorized Trustees in the US to create Deferred Sales Trusts a shrewd and legal way to defer capital gains tax and reduce the overall tax.

June 28th 2021 by Brett Swarts founder of. 408-252-8900 Real Estate Agent with Get Results. In every single one of these deferred sales trust audits for individual clients that were not triggered by the deferred sales trust by the way there were no changes.

Those of us with clients that own businesses highly appreciated stock commercial or residential investment real estate assets we often find those clients who. If a deferred sales trust is improperly managed and the IRS. Deferred Sales Trust at the close of sale either through escrow or attorney.

Talk to an expert now called Brett at Capital Gains Tax Solutions. Installment sales had been. Deferred Sales Trusts provide a strategy for deferring capital gains taxes on appreciated assets usually when a person is exchanging one asset class for another.

California Tax Board Disallows Deferred Sales Trusts Monetized Installment Sales

The Cost Of Setting Up A Deferred Sales Trust Is Too High Or Is It Reef Point Llc

Attorneys And Deferred Sales Trust Reef Point Llc

Sell Your Business With Maximum Gains Via Deferred Sales Trust With Brett Swarts Seiler Tucker

Deferred Sales Trust Defer Capital Gains Tax

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Capital Gains Tax Solutions Deferred Sales Trust

Attorneys And Deferred Sales Trust Reef Point Llc

Capital Gains Tax Deferral Capital Gains Tax Exemptions

Deferred Sales Trust The Other Dst

Capital Gains Tax Solutions Deferred Sales Trust

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

State Of California Real Estate Withholding Viva Escrow

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

How A Tax Deferred Cash Out Works

Sell Your Business With Maximum Gains Via Deferred Sales Trust With Brett Swarts Seiler Tucker

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway